Texas Housing Insight

Texas A&M Real Estate center has come up with another comprehensive review of the housing market in our area. I wanted to share it with my dedicated blog readers. As always, if you need any help buying, selling, or appraising your home, please feel free to call or message me at any time! Have an amazing summer!

Texas housing sales inched down monthly after a record-breaking April but continued a general trend upward. The average days on market remained stable, while lower mortgage rates and home-price appreciation eased the decline of housing affordability. On the supply side, single-family housing permits and starts trended upward, but more meaningful gains are necessary to satisfy demand. Builders moved toward smaller lot and home sizes to provide more affordable options, but the premium for a new rather than an existing home remained substantial. The shortage of homes priced below $300,000 remained the biggest challenge facing the housing market. Texas’ robust economy and population growth, however, support a favorable outlook.

Supply*

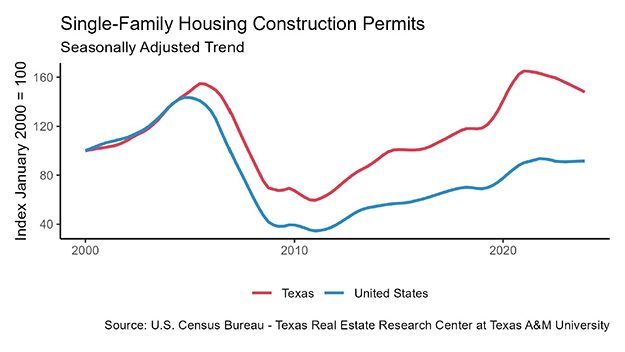

The Texas Residential Construction Cycle (Coincident) Index, which measures current construction activity, inched downward during an extended slide in construction values. The Residential Construction Leading Index, however, reached its highest level since the Great Recession amid low interest rates as well as a rebound in construction permits and housing starts. The extended economic expansion in Texas and across the nation bodes well for the housing market.

Single-family construction permits increased for the fifth consecutive month after sliding in the second half of 2018. Texas accounted for 16 percent of the national total, remaining the frontrunner with 10,946 (nonseasonally adjusted) monthly permits issued. Houston and Dallas-Fort Worth topped the list at the metropolitan level with 3,690 and 2,945 permits, respectively, as they climbed from last year’s correction. North Texas growth was led by the Dallas-Plano-Irving metropolitan division, but momentum eased in Fort Worth-Arlington after three years of explosive growth. The number of permits issued year to date (YTD) in Houston and Dallas-Fort Worth, however, registered below the levels recorded during the first five months of 2018. In contrast, Austin’s growth accelerated to 12 percent year over year (YOY), issuing more than 1,700 permits in May. San Antonio posted similar growth levels and issued 875 permits, outpacing larger metros such as Seattle, Miami, and Chicago.

Total Texas housing starts surpassed 16,000 for the first time this year and showed signs of breaking from a four-year stagnation. Lower interest rates and lumber prices fueled activity, but the current pace remains insufficient to meet the demands of a growing population and economy. Unlike permits, single-family private construction values have not stabilized since the mid-2018 peak and have decreased in eight of the last ten months. The slide is concerning, but positive developments in earlier stages of the construction cycle portend improvements.

Housing starts had little effect on Texas’ months of inventory (MOI), which held firmly at 3.8 months. The number of active listings is dominated by the resale market and thus relies more on new listings of existing homes. Last year’s stretch of slow and steady inventory growth stalled amid rebounding demand and fewer new Multiple Listing Service listings. A total MOI around six months is considered a balanced housing market. Different segments of the market displayed wide variation in inventory levels. The MOI for homes priced less than $300,000 slid below 2.9 months, while the MOI surpassed 9.2 months for luxury homes (those priced more than $500,000). These divergent trends exemplify the growing shortage of affordable housing and the current mismatch between demand and supply.

The MOI stabilized across the major metros after marginal gains last year. In Dallas and Fort Worth, the MOI settled at 3.4 and 2.6 months, respectively, while trending at 4.0 months in Houston. The San Antonio metric held at 3.6 MOI for the fifth consecutive month. Austin was the exception where the MOI trended downward to 2.5 months. The supply of active listings was constrained across the capital city’s price spectrum, ranging from 4.7 MOI for luxury homes to below 1.9 months for those priced less than $300,000.

Demand

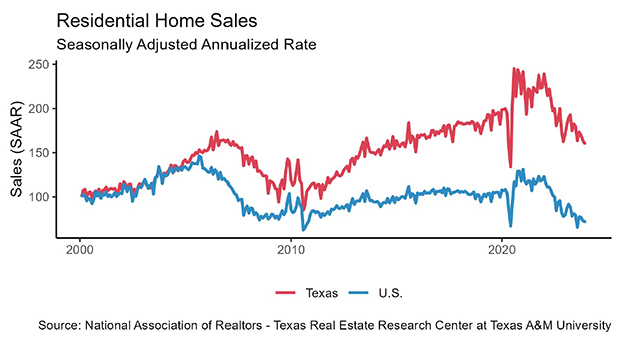

Total housing sales inched down after a record-breaking April but remained on an upward trend as lower mortgage rates stimulated purchasing activity. Existing homes, which are typically cheaper than new-home equivalents, accounted for most of this year’s rebound as buyers shifted toward lower-priced options. Builders continued to offer smaller home sizes, but the median new-home price remained 30 percent above that for existing homes.

Sales hovered around record levels in all of the major metros, maintaining the solid growth that accrued in the first quarter. Dallas and Fort Worth posted 11.9 and 7.3 percent YTD growth, respectively, as North Texas continued to recover from last year’s dip. Central Texas sales maintained a stark upward trajectory, increasing more than 10 percent YTD in both Austin and San Antonio. Houston sales increased 7.6 percent YTD amid solid growth for homes priced more than $400,000.

Robust demand pulled Texas’ average days on market (DOM) below 59 days, but market movements were mixed across the major metros. Dallas homes sold after an average of 54 days, a full 11 days slower than in May of last year. On the other hand, Fort Worth’s DOM held below 43 days and showed signs of trending lower. The DOM in Austin, Houston, and San Antonio remained stable on a two-year trend around 58 days.

Continued concerns about global economic growth and trade uncertainty pulled interest rates down for the seventh consecutive month. Long-term rates fell faster than those for short-term instruments, inverting the yield curve and stirring talks of a recession. Economic fundamentals at the state and national level, however, remain healthy and stable. Interest rates could fall further in anticipation of the Federal Reserve’s possible rate cuts this year due to a low inflation environment. The ten-year U.S. Treasury bond yield fell to an annual low of 2.4 percent, while the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate dropped below 4.1 percent. Mortgage applications fell in both Texas’ refinance and purchase market but remained positive YTD.

Prices

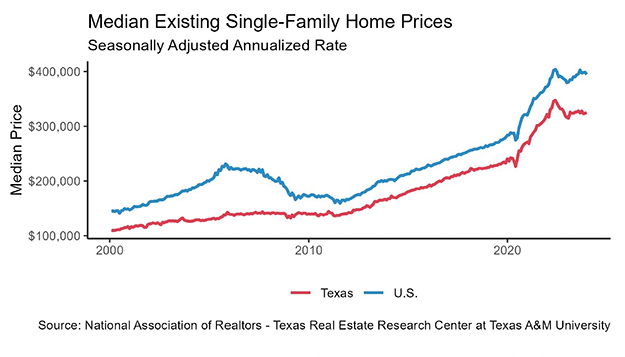

The Texas median home price dipped below $236,500 after four consecutive monthly increases, growing at an annual rate of 2.3 percent. While still increasing, home prices are no longer soaring at double-digit growth levels. Texas’ median price for new and existing homes trailed the respective national median by $14,500 and $41,400.

Home-price appreciation moderated in the major metros according to the Texas Repeat Sales Index. San Antonio maintained the strongest growth at 4.7 percent YOY, but the median home price ($226,300) held below the statewide level. The Austin median reached a record level $317,200 as the index rose 3.4 percent. Similar growth in Fort Worth pushed the median price above $238,800. In Dallas ($287,000) and Houston ($239,700) the median price continued to soften as the repeat sales indices slowed to 1.8 and 2.2 percent YOY growth, respectively.

________________

*All monthly measurements are calculated using seasonally adjusted data, and percentage changes are calculated month over month, unless stated otherwise.